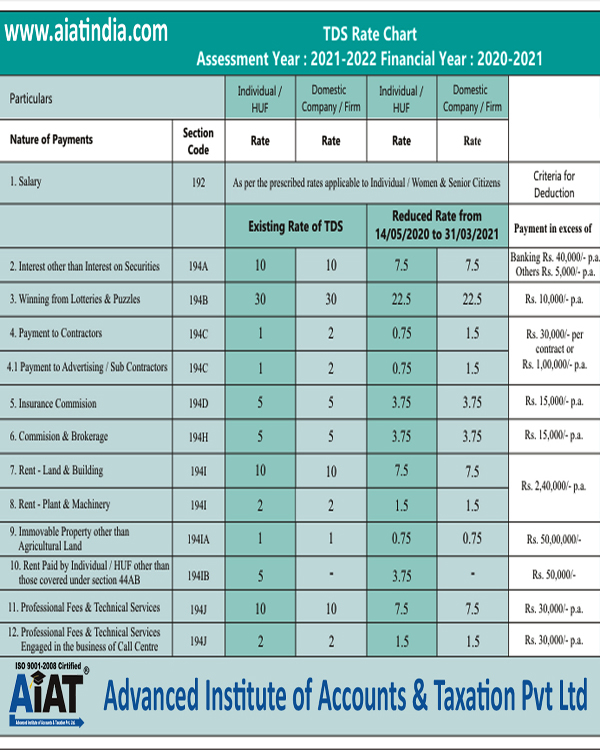

TDS Rate Chart for FY 2020-21

TDS stands for Tax Deducted at Source. The following tables list the various TDS rates applicable to resident in India. Any person paying income is responsible to deduct tax at source and needs to deposit this tax within the time stipulated.

TDS Rates Applicable for Resident of India

|

Particulars |

TDS Rate (%) |

TDS Rates from 01.04.2020 to 13.05.2020 |

TDS Rates from 14.05.2020 to 31.03.2021 |

|

Section 192: Payment of salary Section 192A: Premature withdrawal from EPF |

10 |

10 |

10 |

|

Section 193: Interest on securities. a) any debentures or securities for money issued by or on behalf of any local authority or a corporation established by a Central, State or Provincial Act; b) any debentures issued by a company where such debentures are listed on a recognized stock exchange in accordance with the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and any rules made thereunder; c) any security of the Central or State Government; d) interest on any other security |

10 |

10 |

7.5 |

|

Section 194: Dividend other than the dividend as referred to in Section 115-O |

10 |

10 |

7.5 |

|

Section 194A: Income by way of interest other than “Interest on securities” w.e.f 1st April 2018, interest up to Rs. 50,000 earned by senior citizens on: – deposit with banks – deposit with post offices – fixed deposits schemes – recurring deposit schemes will be exempt from TDS w.e.f 1st April 2019, TDS on the interest income from post offices and bank deposits have increased up to Rs. 40,000 from the present limit of Rs. 10,000. |

10 |

10 |

7.5 |

|

Section 194B: Income by way of winnings from lotteries, crossword puzzles, card games and other games of any sort |

30 |

30 |

30 |

|

Section 194BB: Income by way of winnings from horse races |

30 |

30 |

30 |

|

Section 194C: Payment to contractor/sub-contractors. a) HUF/Individuals b) Others |

1 2 |

1 2 |

0.75 1.5 |

|

Section 194D: Insurance commission |

5 ( w.e.f 01.06.2016) (10% from 01.04.2015 to 31.05.2016 |

5 |

3.5 |

|

Section 194DA: Payment in respect of a life insurance policy |

5 (w.e.f 01.09.2015) 1 ( w.e.f 01.06.2016) (2% from 01.04.2015 to 31.05.2016) |

5 |

3.75 |

|

Section 194EE: Payment in respect of deposit under National Savings scheme |

10 (w.e.f 01.06.2016) (20% from 01.04.2015 to 31.05.2016) |

10 |

7.5 |

|

Section 194F: Payment on account of repurchase of a unit by Mutual Fund or Unit Trust of India |

20 |

20 |

15 |

|

Section 194G: Commission, etc., on the sale of lottery tickets |

5 (w.e.f 01.06.2016) (10 % from 01.04.2015 to 31.05.2016) |

5 |

3.75 |

|

Section 194H: Commission or brokerage |

5 (w.e.f 01.06.2016) (10 % from 01.04.2015 to 31.05.2016) |

5

|

3.75 |

|

Section 194-I: Rent on a) Plant & Machinery

b) Land or building or furniture or fitting

W.e.f 1st April 2019, TDS limit for deduction of tax on rent is increased to Rs. 2,40,000 p.a from Rs.1,80,000 p.a. |

(a) 2

(b) 10 |

2

10 |

1.5

7.5 |

|

Section 194-IA: Payment on transfer of certain immovable property other than agricultural land Section 194 – IB: Rent payable by an individual or HUF not covered u/s. 194I (w.e.f from 01.06.2017) Section 194 – IC: Payment under Joint Development Agreements to Individual/HUF (w.e.f. 01.04.2017) |

1

5 (w.e.f from 01.06.2017) (If payment of Rent exceeds Rs. 50,000/- per month.) 10 |

1

5

10 |

0.75

3.75

7.5 |

|

Section 194J: Any sum paid by way of: a. Fee for professional services (b) Remuneration/fee/commission to a director ore) (c) For not carrying out any activity in relation to any business. (d) For not sharing any know-how, patent, copyright etc. (e) Fee for technical services and (f) Royalty towards the sale or distribution or exhibition of cinematographic films. |

10

2 |

10

2 |

7.5

1.5 |

|

Section 194 K:Payment of any income in respect of (a) units of a mutual fund as per section 10(23D); or (b) the units from the administrator; or (c) units from specified company (w.e.f. 01.04.2020) |

10 |

10 |

7.5 |

|

Section 194LA: Payment of compensation on acquisition of certain immovable property |

10 |

10 |

7.5 |

|

Section 194LBA: Certain income distributed by a business trust to its unit holder |

10 |

10 |

7.5 |

|

Section 194LBB: Certain income paid by an investment fund to its investors |

10 |

10 |

7.5 |

|

Section 194 LBC: Income in respect of investment in securitization fund

|

25

30 |

|

|

|

Section 194M: Certain payments by Individual/HUF (Limit - 50 Lakhs) |

5 |

5 |

3.75 |

|

Section 194N: Payment of certain amount in cash (Limit 1 Crore) |

2 |

2 |

2 |

|

Section 194N: Payment of certain amount in cash (first proviso of section 194N)if- - The amount is more than Rs.20 lakh but up to Rs. 1 crore - The amount exceeds Rs. 1 crore (Applicable from 01.07.2020) |

- |

2 5 |

2 5 |

|

Section 194O: Applicable for e-commerce operator for the sale of goods or provision of services facilitated by it through its digital or electronic facility or platform (Applicable from 01.10.2020) |

1 |

- |

0.75 |

|

Any Other Income |

10 |

10 |

10 |